By Invite Only

September 8-9, 2025

Newport, RI

FILTER BY TOPIC

Come out for this spirited Davis Cup style tournament pitting Boston private equity & venture capital investors against Boston entrepreneurs and operating executives. Of course, it’s all for a good cause, the not-for-profit Tenacity program that uses tennis and mentoring to help at-risk inner-city youth grow and achieve (www.tenacity.org).

Cost: $195 includes the court fee, cocktails, appetizers, and networking!

Social Ticket: $100 includes cocktails, appetizers, and networking!

You can participate as a PE team player if you are a PE investor with a dedicated fund. If you nominate a portfolio company operating executive, they can go on the operating team ($195/head). If you’re an advisor, you can underwrite the event and have 2 players of your choice ($2,500 for sponsorship).

**We are excited to continue to offer Corporate Team Sponsorship again this year**

As an individual player, the cost per player is $195. Individual players will be assigned a partner from the rest of the player pool on tournament day. But as a corporate underwriter via the Corporate Team Sponsorship, for a cost of $500, you’ll get admission for 2 and the ability to select your playing partner (“pick your doubles team”)

Sign up for a social ticket and you could come and hobnob on the porch and swill fine craft cocktails while others prance around in whites trying to relive “the good old days” only upheld by Wimbledon in 2025. It’s a lovely afternoon on the veranda overlooking the grass courts in Boston AND in support of Boston’s urban at-risk youth. With a crowd of primarily private equity, VC, and investor-backed company owners/leaders vying for the bragging rights.

Contact Julie Hart at julie@bsgtv.com or Diane Amador at damador@bsgtv.com

for more details and to request an invitation.

We’re excited to share that Talent Sequencing, the parent and sister company of BSG, is a proud sponsor of this year’s ACG New England Conference, returning to Newport, RI from September 8–9, 2025 at the beautiful Newport Harbor Island Resort on Goat Island.

For years, BSG has partnered with ACG to support the region’s most dynamic dealmaking and networking events. This year, we’re especially thrilled to help promote the relaunch of the ACG New England Conference, which will focus exclusively on the lower middle-market—bringing together investors, boutique investment bankers, advisors, and business executives from across New England who are guiding businesses through their first liquidity events.

What sets this conference apart? It’s all about the lower middle-market. Attendees can expect:

Strategic insights and market trends from industry leaders

First-hand experiences navigating the complexities of M&A

1:1 meetings and curated networking opportunities

Unique New England experiences—including tennis at the International Tennis Hall of Fame, sailing, and an oceanside clambake

Talent Sequencing is especially proud to sponsor the conference’s tennis event, offering ACG attendees a chance to play at the legendary International Tennis Hall of Fame—a truly unique addition to the conference lineup.

Exclusive Invitation for Mid-Market PE-Backed CEOs

As part of our sponsorship, we are pleased to offer a limited number of complimentary invitations to our mid-market, PE-backed CEO clients. Please note: this invitation covers the conference itself (not the tennis tournament). Much of the content is designed for C-suite leaders navigating the M&A landscape for the first time.

Space is limited—secure your spot for this exceptional event!

Request an Invitation

If you are a mid-market, PE-backed CEO interested in attending, please reach out to Julie at Julie@BSGtv.com to request your invitation.

We look forward to seeing you in Newport!

As ACG DealFest 2025 approaches, it’s time once again to kick things off with an evening of great conversation, strong connections, and harbor views. Boston Search Group (BSG), in partnership with Blank Rome LLP and Grant Thornton LLP, is proud to invite our extended network of private equity professionals to our annual Pre-DealFest Cocktail Party—a premier networking event for PE dealmakers, operating partners, and PE-backed executives.

Join us for cocktails, conversation, and community.

📅 Date: Tuesday, June 10, 2025

⏰ Time: 6:00–8:00 p.m.

📍 Location: Legal Seafoods Harborside, 270 Northern Ave, Boston, MA 02210

Hosted by:

Joe Volman, Blank Rome LLP

Clark Waterfall, BSG

Mike McPeak, Grant Thornton LLP

Set against the stunning backdrop of Boston’s Seaport, Legal Seafoods Harborside offers the perfect setting to reconnect with industry peers, explore potential collaborations, and toast the private equity community. Whether you’re an investor, operating partner, or portfolio company executive, this event is your chance to unwind and engage before the DealFest mainstage begins.

This is an invite-only event.

To request an invitation or RSVP, please contact julie@bsgtv.com.

Let’s come together to celebrate another year of opportunity, growth, and dealmaking. We look forward to seeing you there!

Come out for this spirited Davis Cup style tournament pitting Boston private equity & venture capital investors against Boston entrepreneurs and operating executives. Of course, it’s all for a good cause, the not-for-profit Tenacity program that uses tennis and mentoring to help at-risk inner-city youth grow and achieve (www.tenacity.org).

Cost: $195 includes the court fee, cocktails, appetizers, and networking!

Social Ticket: $100 includes cocktails, appetizers, and networking!

You can participate as a PE team player if you are a PE investor with a dedicated fund. If you nominate a portfolio company operating executive, they can go on the operating team ($195/head). If you’re an advisor, you can underwrite the event and have 2 players of your choice ($2,500 for sponsorship).

**We are excited to continue to offer Corporate Team Sponsorship again this year**

As an individual player, the cost per player is $195. Individual players will be assigned a partner from the rest of the player pool on tournament day. But as a corporate underwriter via the Corporate Team Sponsorship, for a cost of $500, you’ll get admission for 2 and the ability to select your playing partner (“pick your doubles team”)

Sign up for a social ticket and you could come and hobnob on the porch and swill fine craft cocktails while others prance around in whites trying to relive “the good old days” only upheld by Wimbledon in 2023. It’s a lovely afternoon on the veranda overlooking the grass courts in Boston AND in support of Boston’s urban at-risk youth. With a crowd of primarily private equity, VC, and investor-backed company owners/leaders vying for the bragging rights.

Contact Julie Hart at julie@bsgtv.com or Diane Amador at damador@bsgtv.com

for more details and to request an invitation.

Last week, BSG hosted an exclusive virtual rosé tasting event, bringing together members of the PE middle market community for an evening of delightful wines and networking. Held on Thursday, August 22nd, the event aimed to reconnect old acquaintances and foster new relationships—all while enjoying some of summer’s best rosé selections.

Participants joined from kitchens, backyards, and even board rooms, as they sipped on Whispering Angel and two challenger bottles delivered to their doorsteps. The goal? A friendly "taste-off" to see if Whispering Angel could maintain its crown as the reigning king of summer rosé, or if one of the challengers would take the title.

Hosted by BSG Co-Founder and Managing Partner Clark Waterfall, who doubled as the evening’s amateur sommelier and emcee, the event featured lively discussions, wine trivia, and plenty of laughs. Clark guided guests through each wine, encouraging open conversation and some healthy competition as they crowned their favorite rosé of the evening.

The casual atmosphere allowed for relaxed networking, with many attendees making new connections and rekindling old ones. And while the focus was on fun, the virtual setting didn’t stop the business-minded crowd from exploring potential future deals and partnerships.

Though space was limited for the event, the enthusiasm and energy have inspired plans for future virtual tastings. Keep an eye out for upcoming events, and who knows—perhaps a new favorite rosé or business opportunity is just around the corner.

Stay tuned, and we hope to see you at the next BSG Sip & Socialize!

Get ready to mingle and network because BSG is thrilled to announce our annual pre-ACG DealFest Cocktail Party! Scheduled for June 5, 2024, at the esteemed Legal Seafoods Harborside in Boston's vibrant Seaport District, this event promises an evening of lively conversation and valuable connections.

As a prelude to the much-anticipated ACG DealFest, our cocktail party, hosted by BSG and Grant Thornton, serves as a premier gathering for industry leaders, professionals, and enthusiasts within the private equity community. Set against the backdrop of Boston's stunning harbor, attendees will enjoy a relaxed atmosphere conducive to forging meaningful relationships and exploring potential collaborations.

At BSG, we understand the significance of fostering connections in the dynamic landscape of private equity. Our cocktail party provides a platform for like-minded individuals to exchange insights, share experiences, and cultivate partnerships that drive mutual success.

Legal Seafoods Harborside, renowned for its fresh seafood and picturesque waterfront views, serves as the perfect venue for this exclusive event. With delectable hors d'oeuvres and refreshing beverages on offer, attendees can indulge their palates while engaging in productive discussions.

Whether you're a seasoned professional or a rising star in the private equity realm, our pre-ACG DealFest Cocktail Party offers a valuable opportunity to expand your network and broaden your horizons. Join us on June 5th as we come together to celebrate innovation, collaboration, and the boundless possibilities that lie ahead in the world of private equity.

Mark your calendars and stay tuned for more details on how to secure your spot at BSG's premier networking event of the year. We look forward to welcoming you to an unforgettable evening of connection and camaraderie at Legal Seafoods Harborside!

For inquiries and RSVP, please contact julie@bsgtv.com.

Are you ready to merge business networking with a touch of leisurely competition? Then let's delve into what BSG has in store for its upcoming Pickleball Round Robin event, set to take place during Deal Max 2024 at The Plaza Hotel in Las Vegas on Monday, April 29th, from 9:00 am to 12:00 pm.

Last year, amidst the whirlwind of the ACG DealMAX 2023 meeting, BSG introduced its inaugural PE/ibanker pickleball round-robin invitational. The event was met with enthusiasm, as participants enjoyed not only the thrill of the game but also the opportunity to foster new connections and burn off a few extra calories in the process.

This year, BSG is gearing up to deliver an even more memorable experience. So, what can you expect?

In summary, BSG's Pickleball Round Robin event at Deal Max offers a unique opportunity to blend business and recreation in one unforgettable experience. Whether you're looking to strengthen existing connections or forge new ones, we invite you to join us for a morning of camaraderie, competition, and fun.

Stay tuned for more details as the event draws nearer – we can't wait to see you on the court!

Interested in joining us? Request an invite via email to Julie Hart at julie@bsgtv.com.

In keeping with our love of private equity, philanthropy, and racquet sport mashups, BSG is proud to announce our latest charity tournament--now with pickleball! Join us on Thursday, November 16th in Boston as we Dink Responsibly at Bosse Sports and enjoy cocktails, apps & networking with Roundhead Brewing Company.

This is an RSVP event. To request a spot, please email Julie Hart at Julie@BSGTV.com.

RESCHEDULED DUE TO WEATHER - NOW OCTOBER 6th--BSG is proud to announce the return of its annual charity tennis tournament on September 29, 2023. A mainstay of BSG's event calendar, the annual tennis tournament benefitting Tenacity has run successfully every year (with the exception of during covid) for 15 years now. BSG welcomes the private equity community to join us on the grass courts in Chestnut Hill, MA for a gorgeous fall day of tennis and networking.

You can participate as a PE team player if you are a PE investor with a dedicated fund. If you nominate a portfolio company operating executive, they can go on the operating team ($195/head). If you’re an advisor, you can underwrite the event and have 2 players of your choice ($2,500 for sponsorship).

**We are excited to continue to offer Corporate Team Sponsorship again this year**

As an individual player, the cost per player is $195. Individual players will be assigned a partner from the rest of the player pool on tournament day. But as a corporate underwriter via the Corporate Team Sponsorship, for a cost of $500, you’ll get admission for 2 and the ability to select your playing partner (“pick your doubles team”)

You could come and hobnob on the porch and swill fine craft cocktails while others prance around in whites trying to relive “the good old days” only upheld by Wimbledon in 2023.

It’s a lovely afternoon on the veranda overlooking the grass courts in Boston AND in support of Boston’s urban at-risk youth. With a crowd of primarily private equity, VC, and investor-backed company owners/leaders vying for the bragging rights.

Check out the highlights from 2021:

15th Annual Investors vs. Operators Tennis Tournament

Doubles Round Robin

Location: Chestnut Hill, MA

Date: Friday, September 29, 2023

Time: 1:00-7:00 pm

Cost: $195 includes the court fee, cocktails, appetizers, and networking!

Social Ticket: $100 includes cocktails, appetizers, and networking!

Contact Julie Hart at julie@bsgtv.com or Diane Amador at damador@bsgtv.com

for more details and to request an invitation.

| |

|

As part of BSG's 25th anniversary PE tour, we're bringing pickleball to private equity, everywhere we go! After a very successful and enjoyable first annual pickleball round-robin prior to ACG's DealMax in Vegas, we're bringing our next pickleball event to Boston on June 22nd!

But that's not all—first join us on June 21st from 6pm to 8pm at Legal Seafoods Harborside for an evening cocktail party for PE attendees and hosted by BSG, Burns & Levinson, and Grant Thornton.

Then, kick off the DealFest conference by joining us at PKL on June 22nd from 8am to 10am at our PE/I-banker pickleball round-robin. Equipment is provided and the facility is brand-new and chock-full of amenities.

Enjoy it all with us—request an invite to one or both events by emailing julie@bsgtv.com.

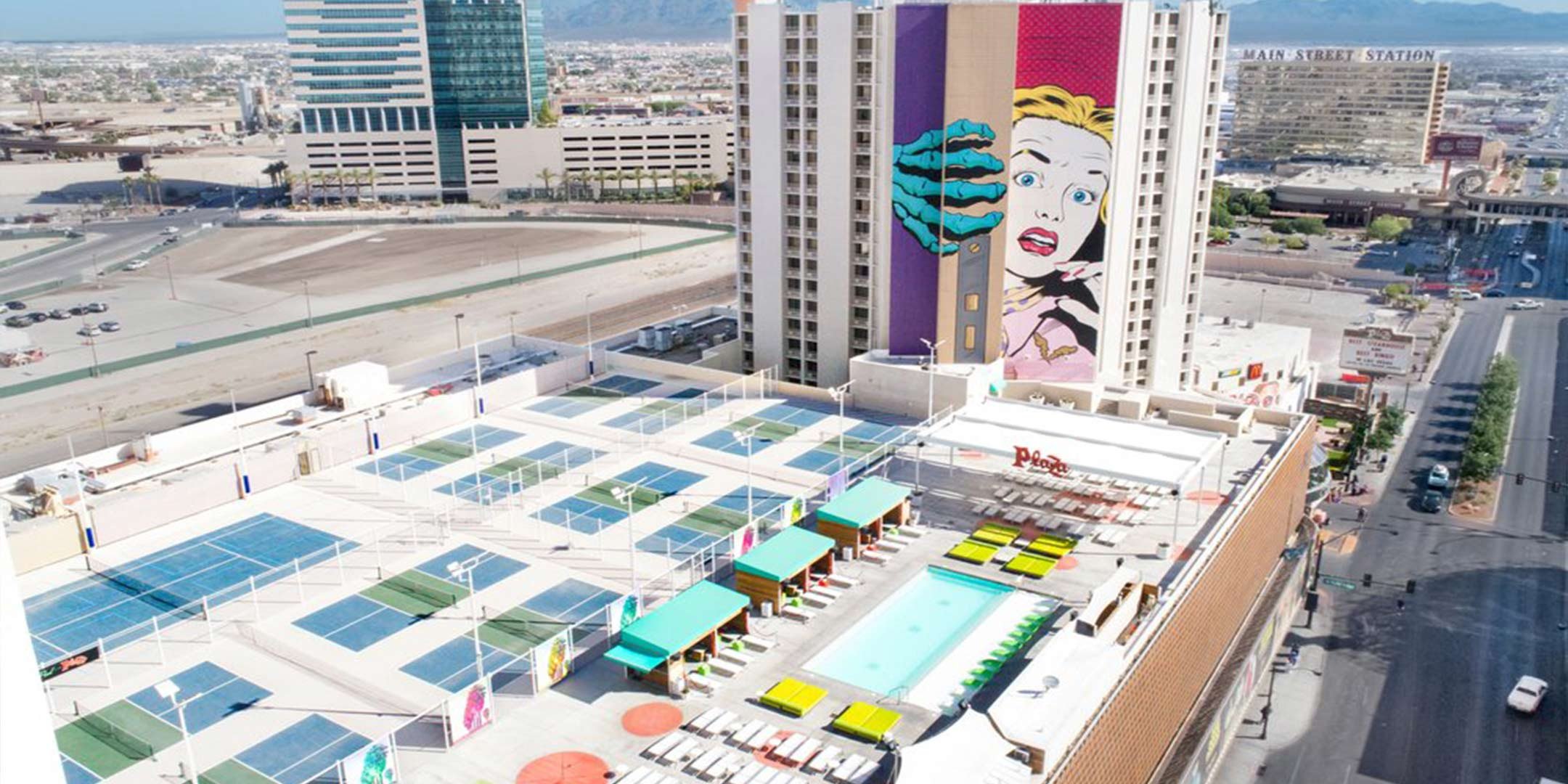

photo: Vegas attendees enjoyed pickleball on the rooftop of the Plaza Hotel

photo: Vegas attendees enjoyed pickleball on the rooftop of the Plaza Hotel

As part of BSG's 25th anniversary PE tour, we're bringing pickleball to private equity, everywhere we go! After a very successful and enjoyable first annual pickleball round-robin prior to ACG's DealMax in Vegas, we're bringing our next pickleball event to Boston on June 22nd!

But that's not all—first join us on June 21st from 6pm to 8pm at Legal Seafoods Harborside for an evening cocktail party for PE attendees and hosted by BSG, Burns & Levinson, and Grant Thornton.

Then, kick off the DealFest conference by joining us at PKL on June 22nd from 8am to 10am at our PE/I-banker pickleball round-robin. Equipment is provided and the facility is brand-new and chock-full of amenities.

Enjoy it all with us—request an invite to one or both events by emailing julie@bsgtv.com.

photo: Vegas attendees enjoyed pickleball on the rooftop of the Plaza Hotel

photo: Vegas attendees enjoyed pickleball on the rooftop of the Plaza Hotel

BSG invites fellow private equity investors and i-bankers for casual networking outdoors on 10 pickleball courts located right on the Vegas strip in round-robin format while at ACG DealMAX in Las Vegas this May.

This is an excellent opportunity for middle-market PE and i-bankers to network socially over a game of pickleball. If you're interested, please don't hesitate to reach out and we'll provide further information.

Show off your pickle mojo, or easily pick up the game-crazing sweeping the US and build new relationships across the net. And then hit the pool or bar for more…. Join us Monday, May 8th at The Plaza Hotel in Las Vegas from 9am to 12pm and check out this great pickleball locale!

For an invite, please email Julie Hart at julie@bsgtv.com

UPDATE: Tennis Tourney rescheduled to October 14th due to forecasted weather!

BSG is excited to announce that we are celebrating the 15th year of our charity tennis tournament for Tenacity.

You can participate as a PE team player if you are a PE investor with a dedicated fund. If you’re nominating a portfolio company operating executive, they can go on the operating team ($195/head). If you’re an advisor of any kind, you can underwrite the event and have 2 players of your choice ($2,500 for sponsorship).

You could come and hobnob on the porch and swill fine craft cocktails while others prance around in whites trying to relive “the good old days” only upheld by Wimbledon in 2022.

It’s a lovely afternoon on the veranda overlooking the grass courts in Boston. AND in support of Boston’s urban at-risk youth. With a crowd of primarily private equity, VC, and investor-backed company owners/leaders vying for the bragging rights.

Here is a quick video to give you a flavor/taste from last year’s.

15th Annual Investors vs. Operators Tennis Tournament

Doubles Round Robin

Location: Chestnut Hill, MA

Date: Friday, September 23, 2022

Time: 1:00-7:00pm

Cost: $195 includes court fee, cocktails, appetizers and networking!

Social Ticket: $100 includes cocktails, appetizers and networking!

Contact Julie Hart at julie@bsgtv.com or Diane Amador at damador@bsgtv.com

for more details and to request an invitation.

BSG Joins Core Middle Market Heavy Hitters

From the Northstar Site: This core middle market-focused event is exclusively for Private Equity and Investment Banking Firms representing and acquiring companies with EBITDA of $30M-$100M. These events are held at Soldier Field Stadium in Chicago with industry focuses such as Business Services, Healthcare, Food & Beverage, Energy, and Industrials.

We pride ourselves in creating events that not only optimize your firm's time and productivity but also are the most economical for your bottom line. Northstar offers an exclusive environment where you not only meet with firms that are relevant to your industry, but that will foster valuable deal flow for your firm.

The first glimpses of spring and hints of promising news on the pandemic horizon have our events team feeling pretty positive these days. So much so that we're actively looking forward into the fall of 2021 to plan our annual Investors vs. Operators Tennis Tournament. Since we've still got a little ways to go to get to this stage of post-pandemic life, we're satisfying our urge to get out on the courts by revisiting tournaments past. Whether you've been a long-time participant or may join us for the first time this year, we invite you to get to know more about our annual tournament, the people involved and the charitable purpose behind it all.

Contact Julie Hart at julie@bsgtv.com or Diane Amador at damador@bsgtv.com

for more details and to request an invitation.

Join us for a celebration of deal making as we bring together the private equity community prior to the ACG DealFest conference taking place at the Lawn on D. Along with Burns & Levinson and Grant Thornton we’re pleased to host a Rooftop Cocktail Reception at Yotel in the Seaport District, featuring curated wines, cocktails, and apps from 4:30-6:00pm. Mingling there? PE investors, operating partners and PE backed CEOs. Great opportunity to rekindle old relationships and forge some new ones.

When:

Tuesday, September 21, 2021

4:30pm - 6:00pm

Where:

Yotel

65 Seaport Blvd.

Boston, MA 02210

Hosted by:

Clark Waterfall, BSG Team Ventures

Josef Volman, Burns & Levinson LLP

Mike McPeak, Grant Thornton LLP

The buds may just be breaking at the vineyards but we are ready to celebrate the beginning of spring and the return of life. To welcome in the vernal equinox and shake off the winter, we’re hosting a wine tasting.

In partnership with Mike McPeak of GrantThornton, guests will meet via Zoom on Thursday, April 8th for a fun and informative “Virtual Wine Tasting”! This event is by invite only. Guests will be introduced to delicious wines (that will ship directly to them), which we will taste throughout the evening. Wine orders need be placed by March 19, 2021 to ensure timely shipment so timely RSVPs are imperative.

To request more information on this or future wine tasting events, please email Julie Hart, julie@bsgtv.com.

This year's annual Private Equity CEO Exit Panel is in partnership with ACG, the M&A Outlook Conference 2020. Join us by registering here.

Join us for our annual M&A Outlook Conference - fully virtual this year! You’ll hear from CEOs who successfully exited their businesses amidst the pandemic, as they share their experiences and lessons learned. And back by popular demand, to follow up on his predictions made to our members in late April 2020, Jeff Mortimer will be back to share his perspective and forecasts for what’s ahead in 2021.

The M&A Outlook Conference will be hosted on the Remo platform, giving you opportunity to network in a virtual ballroom environment, and allowing for more natural and flexible connections with your fellow deal professionals from across the country.

One of the chief challenges to 2020 is finding ways to supplement our usual partner engagements. In private equity, many of our key connections come from the conversations that happen when we aren't specifically working on business. The social activities that surround our typical event calendars are missed—not just for levity but for our interpersonal relationships.

It didn't take us long to pivot to virtual events, and we hit a great stride with our virtual wine tasting series beginning this summer and continuing today. So much so in fact, that we've been teaming with private equity firms and advisors to bring groups together again in ways, albeit virtually, where we can once again enjoy the social activities and connections we've missed for so long.

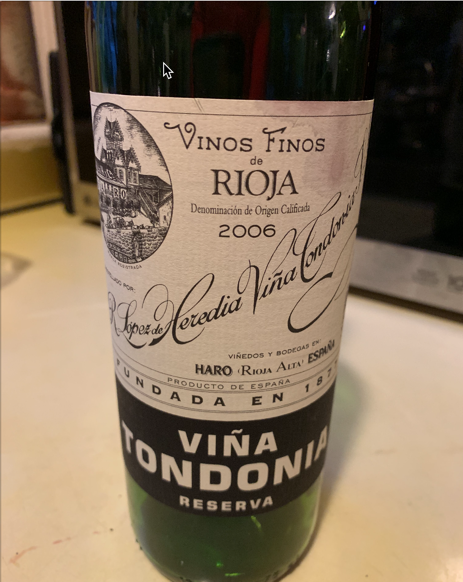

On November 12th, we enjoyed our BSG-Falcon “France vs. US” wine discovery event. Many thanks to our wine expert, and former BSG co-founder, Ralph Protsik for the wine selection and education, as well as to Falcon's Michel Bayard & Kevin Greener co-conspirators.

To help everyone connect, we sent out a list of participant bios ahead of the evening. We encourage our attendees to continue to connect with those whom they'd like to carry on a discussion.

For anyone interested in our wine selection for the evening, we've included those here. Interested in teaming up with us or attending one of our events? Email Julie Hart for more information - Julie@BSGTV.com

The next in our BSG Virtual Cooking Series, this session will focus on Apps.

An invite-only virtual wine tasting co-sponsored with Joe Volman (Burns Levinson).

BSG and K&L Gates are teaming up to host a one-of-a kind “Virtual Wine Tasting” presented by our friend Anthony Giglio, Wine Director for the American Express Centurion Global Lounge Network and Contributing Wine Editor at FOOD & WINE.

BSG and K&L Gates are teaming up to host a one-of-a kind “Virtual Wine Tasting” presented by our friend Anthony Giglio, Wine Director for the American Express Centurion Global Lounge Network and Contributing Wine Editor at FOOD & WINE.

This event is by invite only and we would be delighted if you are able to join us.

Anthony will takes us on an "Around California in 4 Glasses journey" and introduce us to 4 delicious whites and reds (that will ship directly to you), which we will taste throughout the evening. Details follows:

Date | Tuesday August 4 |

Time | 5:00 pm ET |

Location | Your living room/bar/kitchen Zoom invite will be forwarded to you |

Dress | Casual Attire |

Kindly request an invitation by emailing officemanager@bsgtv.com.

The annual ACG Intergrowth conference is a “must attend” for BSG Principals every year. As is the case still sweeping the world, this year’s late spring event was cancelled due to COVID-19. The Association for Corporate Growth (www.acg.org) quickly pivoted and introduced the ACG Member Summit, a virtual 3-day event, held during the week of June 23rd. This event leveraged innovative new technology which allowed for presentations, one-on-one meetings, as well as networking. Overall, given the first time effort and the venture into the unknown, sincere kudos all around to the ACG organizers for pulling off a great event… from the comfort, convenience, and safety of our own living rooms, studies, dens, and home offices.

Read More Here

An exclusive gathering of key visionaries in the middle market PE space, bringing together talent partners to share and learn from each other. The first of many to come, BSG sister company Talent Sequencing brings this 2-hour roundtable with 3 sessions and a lightning round "Ask Your Peers" session.

Hosted by Talent Sequencing, an assessment & talent optimization services firm for middle market private equity.

We are excited to invite our valued clients, fellow private funds industry leaders and friends of BSG to an evening of cocktails and conversation during ACG New York’s “Middle Market Week.”

Clark Waterfall and Lori Gleeman

By invite only - RSVP required:

Join us for a celebration of dealmaking, bringing together the middle market private equity community on the cusp of the ACG DealFest Northeast 2019 conference.

Hosted by:

Clark Waterfall, BSG

Lew Weinstein, BSG

Josef Volman, Burns & Levinson LLP

Frank Segall, Burns & Levinson LLP

When:

Wednesday, June 12, 2018

4:30 pm - 6:30 pm

Where:

Barcelona

525 Tremont Street

Boston, MA

Tel: 617.266.2600

Please RSVP by Friday, June 8th to Julianne Cooper at cooperj@bsgtv.com

On Thursday, May 9, 2019, BSG will host our 6th annual Spring Private Equity/Middle Market CEO Exits dinner and social event, featuring a panel discussion on “Private Equity backed, Middle Market Exits—Stories Shared, Lessons Learned”. This event brings together 3 or more CEOs who have exited their businesses in the past ~12-18 months to share their stories with a small group of other PE/Middle Market CEOs, CFOs, and PE investors. to know what the economic weather forecast is going to look like in order to plan your business, and work your plan. Event Date: May 9, 2019

HUNT SCANLON - PRIVATE EQUITY RECRUITING

HUNT SCANLON - PRIVATE EQUITY RECRUITINGBSG joined Hunt Scanlon as they hosted private equity leaders, chief talent officers and executive recruiters at the Harvard Club in New York on May 1, 2019 to explore the link between talent and value. We examine why success in the PE community – long synonymous with value creation – is now tied inextricably to talent -focusing on private equity firms in a bidding war for top talent – and how those moving decisively for the right leadership are winning.

CAPITAL ROUNDTABLE CONFERENCE ON PE VALUE CREATION

CAPITAL ROUNDTABLE CONFERENCE ON PE VALUE CREATIONBSG Managing Director Clark Waterfall and Partner Lew Weinstein attended Capital Roundtable Master Class "Best Practices for Creating Value In PE Portfolio Companies" on April 4, 2019 in New York City. With a full day of insights from 20 expert speakers, BSG presents the highlights and takeaways gleaned from attending the sessions.

Business realities post-purchase of middle market private equity backed businesses:

BSG joined over 200 operators, PE investors and investment bankers from around the country for the SaaS & Tech Enabled Services Conference in Philadelphia.

BSG and the broader ACG community enjoyed this highly targeted industry event featuring 1:1 meetings, carefully curated content and focused networking.

Why Did We Attend?

BSG Team Ventures is proud to once again host the 12th Annual

BSG Team Ventures is proud to once again host the 12th AnnualWe are thrilled to have you join us.

Investors vs. Operators Charity Tennis Tournament

Doubles Round Robin on Grass Courts

$195 includes court fee, cocktails, dinner, and networking!

Fri, September 14, 2018

1:00 PM – 7:00 PM EDT

Longwood Cricket Club

564 Hammond Street

Chestnut Hill, MA 02467

One of our favorite industry events, BSG returns to ACG Boston DealFest 2018 this year. Learn more.

DealFest Northeast is the largest and most significant M&A event in the northeast, bringing together more than 600 key deal professionals from across the country – capital providers, intermediaries, corporates and strategics – for two days of efficient and dynamic networking.

Attendees rely on DealFest Northeast – featuring DealFest on June 13 and DealSource Select on June 14 – as a primary source for networking and deal flow every year.

It’s the most effective way to connect with New England’s top private equity and investment banking firms and middle-market M&A professionals to discover new partners, identify untapped sources of deal flow, and sample the region’s best craft beers amidst a lively brewery style atmosphere!

From the Capital Roundtable Event Overview:

Here Are Three Key Reasons Why You Should Join Us

Register here.

Join BSG the evening before the Capital Roundtable Master Class for a lively evening of cocktails and discussion. By Invitation Only.

JOIN BSG AT THIS YEAR'S ACG INTERGROWTH CONFERENCE IN SAN DIEGO.

FROM INTERGROWTH: InterGrowth is the most efficient and productive conference of 2018! For three days in sunny San Diego, attend networking events with top M&A deal-makers, participate in access to capital opportunities through ACG Capital Connection, and hear from renowned industry experts who can help grow your bottom line and shed light on the latest financial trends.

Each spring of each year, BSG recruits and assembles a panel of private equity-backed CEOs who have successfully exited their businesses in the prior 12-18 months to share their lessons learned at a private dinner held for private equity-backed CEOs, and their PE investors at the Dane Estate in Chestnut Hill, Massachusetts. By Invitation Only.

This year's panel includes 4 prominent CEOs who have led successful exits for private equity-backed, middle market companies. Meet them here:

Stephen DeFalco, former CEO of Crane Currency, acquired by Crane & Co, Dec. 2017

Stephen DeFalco leads global, technology businesses. He drove a successful $800M exit at Crane Currency a private equity backed/family owned global technology company focused on supporting the security of currency programs at central banks globally. He is also Chairman at Senseonics, a NYSE listed diabetes care company with a novel implantable continuous glucose monitor. Previously he was CEO of MDS a $1.2B revenue life sciences company with 5000 employees in 29 countries. Prior to that he held leadership positions at US Genomics, PerkinElmer, United Technologies, McKinsey & Company, and IBM.

“Crane Co. of Stamford, Conn., a diversified manufacturer of highly engineered industrial products, announced today that it had signed an agreement to purchase Crane Currency for $800 million from the private equity firm Lindsay Goldberg of New York City, and the Crane family, who own the company jointly.”

Peter McClennen, CEO of Best Doctors, acquired by Teladoc in July 2017

With more than 25 years of healthcare leadership experience, Mr. McClennen has a proven track record of building and managing successful, high-performing organizations focused on growth. In his role as chief executive officer of Best Doctors, he oversaw the global expansion of the company’s product portfolio and eventual acquisition by Teladoc. As president of dbMotion, an innovative provider of medical informatics, Mr. McClennen was integral in building a successful business from its inception. He has also held senior leadership operations positions at noted healthcare leaders Allscripts Health Solutions, GE Healthcare, Fujifilm Medical Systems, and AMICAS Inc.

“In its largest acquisition to date and one of the top digital health deals of the year, Teladoc has acquired second opinion service Best Doctors in a $440 million deal, including $375 million cash and $65 million in equity. Revenue for Best Doctors added up to $92 million last year and is projected to be $100 million this year”

Chris Allen, CEO of iDevices, Investor, Enhanced Capital Partners – undisclosed amount

Chris Allen is President of iDevices and a proud member of the Hubbell family of companies. Prior to iDevices, Chris comes from an investment background having worked for over 15 years for A.G. Edwards & Sons (now Wells Fargo Investments), Prudential Financial and Allstate. When it comes to technology, Chris believes that, “Technology should be invisible to the user and any devices should merely exist to enhance the users daily life.”

“iDevices®, the preeminent brand in the connected home industry, announced today that they have been acquired by Hubbell Incorporated of Shelton, Connecticut. iDevices will join Hubbell’s large portfolio of brands that manufacture and sell electrical and electronic products for residential, commercial, industrial, and utility applications.”

Tom Beecher, former CEO of Cartera Commerce, Investor Comvest Partners– undisclosed amount

Tom is an experienced growth company CEO. He also serves on the Board of Advisors for Ellevation Education, a successful startup serving English Language Learners. Investors include Emerson Collective and Zuckerberg Education Ventures. Previously, he was a member of the Board of Directors at BzzAgent, a successful word-of-mouth marketing company, from 2007 until its 2011 sale to Tesco. Investors included Flybridge and General Catalyst.

“Ebates the pioneer and leader in online cash back shopping and subsidiary of the global Internet services company Rakuten, today announced the acquisition of Cartera Commerce, a leading provider of loyalty marketing solutions and rewards programs that increase revenue and customer loyalty.”

Our report from last year’s “Lessons Learned” event can be previewed here if you’d like to get a flavor for the event and related content.

For invitation inquiries, email officemanager@bsgtv.com

BSG joined the first stop of the ACG industry tour as it descended on Philadelphia for SaaS & Tech Enabled Services.

Held at the Union League in Philadelphia on April 5, 2018, BSG served as a Supporting Sponsor alongside CBIZ, DealCloud, Hamilton Robinson Capital Partners, and PACT.

BSG participated in the annual flagship event in Boston. Get to know more about the event straight from the PartnersConnect website:

Our flagship event returns to the Hyatt Regency in Boston on March 19, 20 and 21. The event features Buyouts East, VCJ East, and the Private Real Estate Summit East. This year we’ll also be tackling content on Emerging Managers, Family Offices and Co-Investments. As part of the PartnerConnect experience, you will meet more than 150 speakers, 200 LPs and 300+ fund managers, bankers and lenders.

New this year: PartnerConnect East will host a Fundraising Bootcamp for GPs, as well as Hosted Roundtables — including LP-Only Sessions, and Roundtables on Diversity and Women’s Issues in the alternatives industry. As usual, our events are curated by the editors of PEHUB, Buyouts and VCJ.

Our one-on-one meetings program, ExecConnect, is now in its 8th year. Through ExecConnect at PartnerConnect East, we will host 450+ meetings between LPs and GPs, in an efficient and convenient private setting. Since inception, we've organized over 9,000 LP-GP meetings, through which billions of equity capital have been committed by LPs to fund managers.

If you're one of the 4,000+ attendees who've joined us the past several years, we look forward to seeing you again. If you haven't attended yet, we hope to see you in March for this one-of-a-kind PartnerConnect experience.

What’s in your calendar this December 18-20, 2017? Edtech founders, investors, and policymakers are gathering for the third annual global innovation education festival and you’re invited!

NY EDTECH WEEK is on a mission to strengthen the army of edtech entrepreneurs solving the world’s biggest education problems. Through a partnership with BSG we’re offering a $299 Innovator Full Access Passes (normally $995).

Redeem this discount using the code EDTECHINNOVATE to reveal the hidden Innovator’s Full Access ticket or use this link to automatically apply the code at purchase.

These tickets are limited so claim your Innovator Full Access Pass today!

Get a preview of NY EDTECH WEEK 2017 with highlights from last year.

Find BSG principals at 2017 Dealfest Northeast, the leading event for PE and IB firms.

We believe that the globe of talent is comprised of two hemispheres – optimizers and builders. Each is critical for different stages of company growth and development.

BSG's focus is on the builders.