Periodically, we make an effort to pull together executive compensation trends and analysis focusing on venture capital backed companies in the United States. The last executive compensation report we put out was in September 2009 (see prior blog post), and focused on C-level compensation, with a further contrasting of founder versus non-founder CEO compensation, both West Coast and East Coast.

This report is similarly focuses on West Coast and East Coast differences in executive compensation, however this time looking at the VP level across the functional organizational structure. For purposes of this report, only companies who broadly fit the definition of "information technology" were used in the analysis, not including biotech, medical device/medical technology, or cleantech.

The titles looked at include the following--

Vice President Business Development

Vice President Engineering

Vice President Marketing

Vice President Sales

Vice President Sales & Marketing

VP Software Development

VP Product Management

Note that below we've only included the analysis of the executive compensation data, in other words the deltas. If you'd like more detail and the information on which we based the analysis, please email damador@bsgtv.com with your name, title, company and business email address, and we can provide you with the baseline full report.

Do keep in mind that this is only one set of data. To draw the best comparables, it's important to do all three data-grabs listed above. Also, this is a "blended" sample set of multiple venture-backed industry sub-sectors in the information technology category. Some industry sub-segments may pay more or less than others with further parsing.

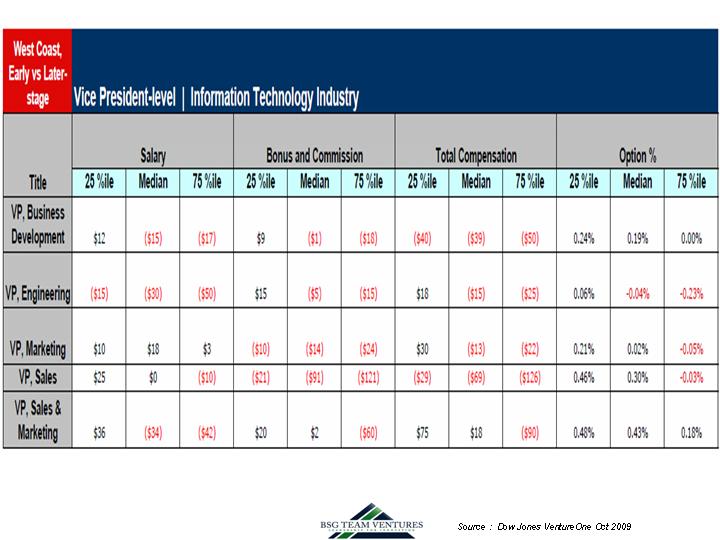

West Coast Early vs. Later-stage Venture Capital-backed Companies

Cash compensation is almost always higher in later stage companies, and this is reflected in all 3 quartiles of data analyzed. For West Coast venture-backed companies, the differences are $15,000 to $50,000 in most roles, with an average different of about $25,000. The only exception is for the VP Sales/Sales Marketing role, where cash was significantly higher in later stage companies for these roles, ranging between $75,000 to more than $125,000 in the top quartile companies.

Conversely, equity is almost always higher in early-stage companies to offset the lower salaries referred to above. For these West Coast companies, regardless of quartile, earlier-stage companies received on average ¼% to ½% more equity, with the biggest jump in VP Sales/Marketing, and lowest in the VP Engineering function.

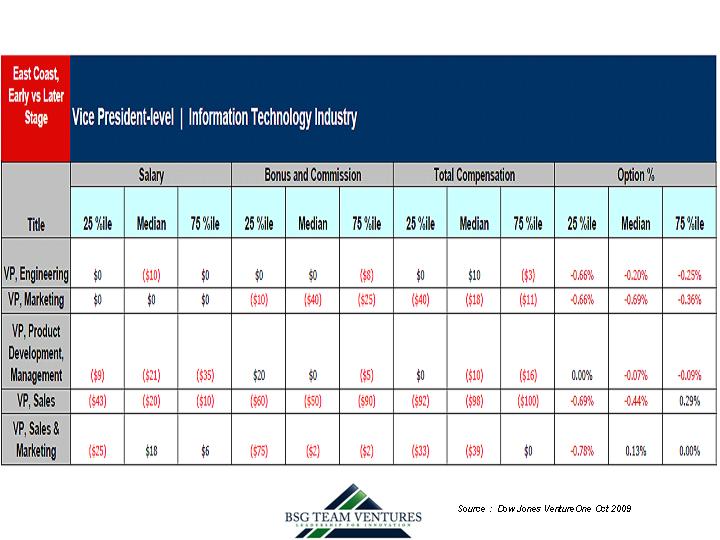

East Coast, Early vs. Later-stage

East Coast compensation tells a different story from their West Coast counterparts. Although cash compensation was similarly lower in early versus later-stage companies, East Coast executives of venture-backed companies didn't see the "make-up" effect in equity. In fact, equity appears lower in many of the quartiles compared, by as much as ½% comparing East Coast early versus East Coast later-stage.

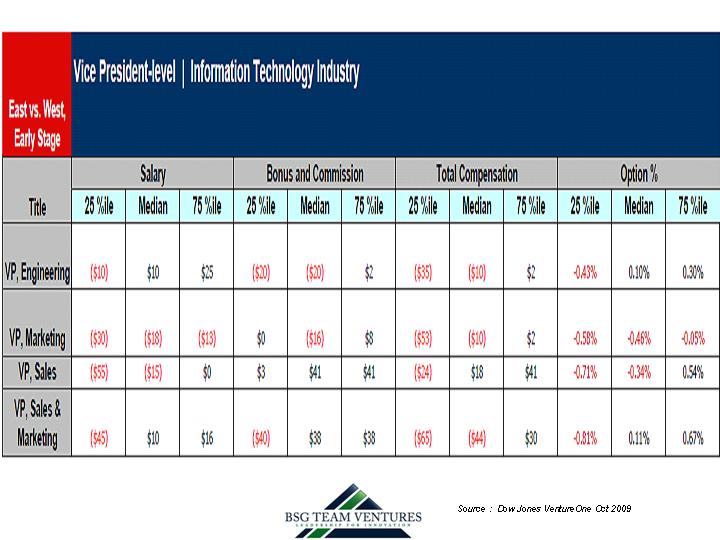

East Coast vs. West Coast, Early-stage

Cash compensation, East versus West, shows that West Coast executives of early-stage companies more often than not earn more in base . West Coast Engineering is $10,000-20,000 more in base, VP Marketing is up West over East by $10,000 to $50,000. VP Sales/Sales & Marketing is actually the one notably lower cash category where East Coasters are better off than West in the higher quartiles (but not the lowest). As noted above, West Coast early-stage executives are compensated more favorably when it comes to equity than their East Coast brethren virtually across the board.

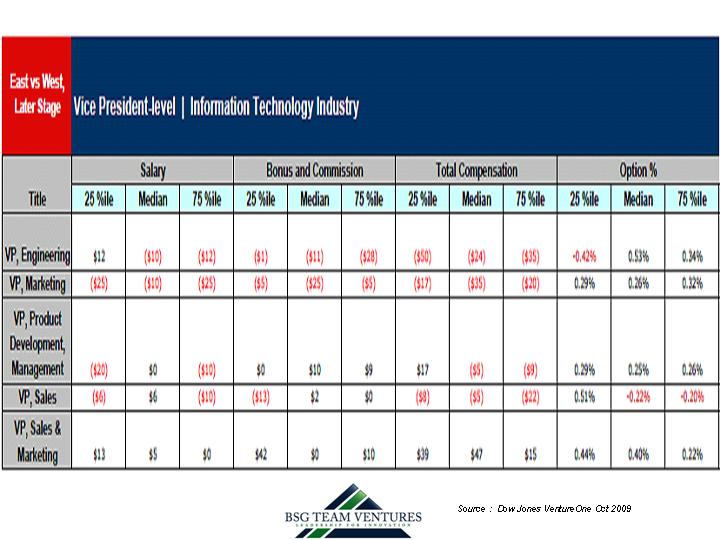

East Coast vs. West Coast, later-stage Venture Capital-backed Companies

As for cash compensation for later-stage companies East vs. West, a similar pattern existed being mostly lower than their West Coast counterparts, than its West Coast peers. However, when looking at equity stakes in later stage companies East vs. West, the East Coast did better, often by ¼% to as much as ½%.