As executive recruiters, we often get asked how executive compensation compares between the two venture capital hot spots in the US — Boston vs. San Francisco. Yes, these areas are larger than their cities, so the Boston area is inclusive of Massachusetts, Southern New Hampshire, and often Rhode Island and Northern Connecticut. San Francisco is even more complicated, with East Bay, Silicon Valley/the peninsula area, San Jose, and Mill Valley/Marin County covering a huge geographic spread.

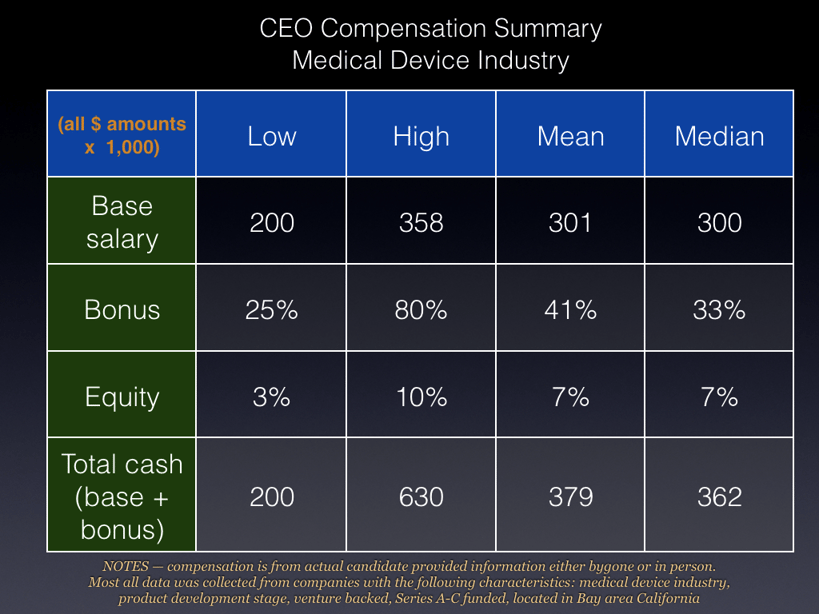

So, often after we finish up a search, we aggregate the compensation data we've collected across the search, and share it back with the innovation community. In this case, we just finished a medical devices CEO search out in the Bay area in September, 2011.

Here is the snapshot of compensation from our survey—

The footnote at the bottom of the image above articulates the following criteria for the majority of companies in this data set:

- Medical devices companies (510K FDA regulatory pathway)

- Venture capital/externally funded

- Product development stage (either pre-revenue, or early revenue stage)

- Series A-C in funding, usually between $5M and $20M raised

There are many variables to consider that influence where to pinpoint one's own compensation vis-a-vis the above:

- The closer to Silicon Valley or urban location like San Francisco, the more likely compensation will be higher

- The later the stage of company development, the higher the CEO compensation, the earlier the lower

- The more money raised, usually the higher the compensation is in the above range

- If key milestones like 510K regulatory or Medicare/Medicaid reimbursement approvals have been granted, CEO compensation is usually higher

- If a non-founder CEO vs. founder-CEO, compensation is likely higher (and equity lower in the range)