THE COMPANY

The company is one of the leading investment companies that has succeeded in beating global markets for more than 20 years through innovation—in financial models, management models, culture and values. The hedge fund’s investing thesis is focused on “global macro”-- using fundamental data, and logical economic relationships, to trade a broad basket of asset classes. Founded more than 30 years ago by the Founder & Chief Investment Officer, the Company has risen to be one of the most respected investing firms in buy-side financial services, managing more than $170 billion in global investments for a wide array of institutional clients, including foreign governments and central banks, corporate and public pension funds, university endowments and charitable foundations. The Company has 1,000 employees and is based in Connecticut.

Does this sound like the opportunity for you? Read on...

THE INDUSTRY

Since the Long-Term Capital blowup, hedge funds have proliferated as never before. Their number reached about 8,532 as of 2006, according to HFR. In 2000, there were just 3,873 worldwide. Lately, the number of funds has grown even faster than the industry's total assets, with more than $1 trillion in total and counting.

Along the way, the firm has become a quiet giant of money management. Its customers include a number of large state retirement systems, foreign governments, pension funds and central banks.

Virtually unknown outside Wall Street circles until the financial crisis in 2008, the firm now surpasses Janus Capital Group Inc., which managed some of the hottest U.S. mutual funds during the 1990s bull stock market and today oversees $139.4 billion. The Company towers over the Magellan Fund, the $50.7 billion flagship of Boston-based mutual fund giant Fidelity Investments. In the hedge fund world, the competition for investors' cash -- and profitable trades -- is fiercer than ever. The founder himself predicted that hedge funds were headed for a shakeout akin to the dot-com bust of the late 1990s that occurred in the 2008 downturn.

THE PHILOSOPHY

There are three ingredients behind the Client’s success: its process, its people, and its culture. At the Company, they have invented, and keep inventing, superior approaches to investing and technology. They have fueled this innovation by recruiting talented, creative people from all backgrounds and promoting an invigorating and collaborative work environment. They are committed to the constant pursuit of excellence, and a meritocracy of ideas, not hierarchies, drives decision-making. The Founder publishes his philosophy for the Company on the public website for all to see.

TECHNOLOGY

Technology is central to their success and to maintaining their competitive edge. Their systematic approach to investing and creative use of technology make their proven track record possible. They’ve become thought-leaders in financial analysis, portfolio management, trade execution, and client service. They understand that in order to have the best performance, they have to have the best people, so they are constantly on the lookout for exceptional candidates from all backgrounds. No financial experience is required. What is required is creativity, initiative, conceptual intelligence, and a personality not only bent on relentless self-improvement, but also open to giving and receiving direct criticism in an environment where every employee is encouraged to challenge and criticize management of all levels.

THE POSITION

Core Responsibilities: Reporting to the Head of Research Technology, the Head of Product for the hedge fund is responsible for partnering with the Research Technology Head on internal product road map, product management related responsibilities, including development prioritization, partnership with the business user side of research to help craft and deliver a robust set of features/functionality used to identify new investment correlations and insights. This is done using internal and external large data sets (big data), analytics and business intelligence tools, and visualization and presentation layer development that is intuitive and customizable.

Key Requirements

Partnering with a team devoted to the use of technology in pursuit of systematic and fundamental understanding of financial markets. A product management expert who can guide development of robust, enterprise technology solutions while strategically modifying, improving, and fine-tuning the product management & product development process around them.

Responsibilities would include:

- Understanding what researchers are doing to comprehend the markets and turn that understanding into a strategic vision for research technology

- Proactively working with the team to identify business problems and design appropriate solutions

- Ensuring all deliverables align with the overall goals and priorities of the department and the specific business problems

- Prioritizing the full application and infrastructure development lifecycle ensuring quality, pace and focus, as well as general adherence to the company’s technical philosophy

- Ensuring that all researchers receive an exceptionally high level of product feature/functionality

- Ensuring that our critical processes are well controlled: fast, safe, transparent, and constantly improving

- Providing partnership and be a culture-carrier for a group of 10-20

- Organizing, shaping, and motivating a team of exceptionally talented software developers, UI/UX specialists, and business analysts

- Proactively managing cross department dependencies and priorities

- Acting as industry expert on technology & product management best practices

GENERAL:

Finally, this individual should have as many as possible of the traits required to succeed in this leadership position:

- High levels of intelligence, analytical strength and conceptual ability.

- The ability, and willingness, to set and communicate demanding standards for professional staff and to hold people accountable for their performance; at the same time, sensitivity to, and insight into individuals’ capabilities and development needs.

- Decisiveness when necessary, coupled with a willingness to seek input and build consensus as much as possible.

- Unquestioned honesty and integrity; also, loyalty to colleagues and to the organization, and the ability to inspire loyalty. This person should have the ability to identify and focus on the Company’s best interests, rather than the agenda of any individual or group within the firm.

- A very high level of energy and commitment, combined with enthusiasm and a positive attitude.

- Excellent writing and speaking skills; this individual must be able to communicate complex ideas and information clearly and concisely.

- Outstanding planning and organization skills.

- Good strategic instincts and long-term vision; the ability to address both big-picture issues and detailed, day-to-day management concerns.

- In general, the business and personal skills, and the absolute commitment, required to make a major contribution to The Company during the coming years.

THE IDEAL CANDIDATE PROFILE

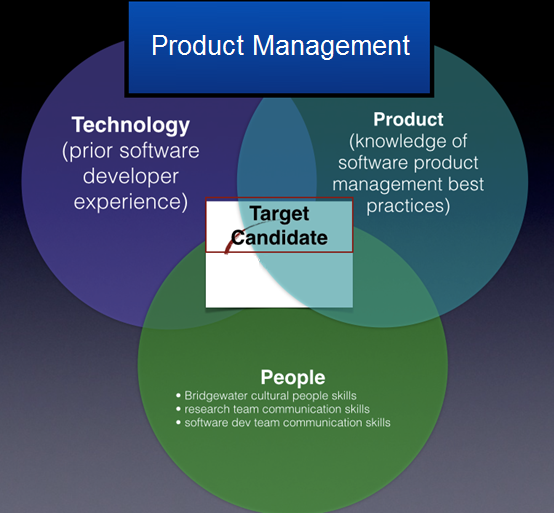

The diagram here illustrates the intersection of competencies critical in the position:

THE TEAM

The company’s software development team is approximately 20. The research business side analyst team is approximately 50. The total company size is approximately 1,000 spread out over 2 primary campuses in Connecticut.

COMPENSATION

Competitive with the position and market requirements. Being a heavily merit-driven culture, a base salary is supplemented with a strong bonus program driven by individual, department, and company results.

FOR MORE INFORMATION...

Please contact:

Clark Waterfall, BSG Team Ventures

Todd Hand, BSG Team Ventures

Diane Amador, BSG Team Ventures