- Rob Day, Black Coral Capital | Michael Balmuth, Edison Ventures | Alexis Borisy, Third Rock Ventures

Once or twice a year we as a firm gather CEOs from the Boston innovation ecosystem to share thoughts amongst themselves. Often, the format is lubricated by a panel to kick things off. Always, the format is lubricated by an open bar and dinner.

This Fall's CEO gathering in early November brought together 50 or so CEOs around the topic of planning for 2011, and what to expect as a CEO.

Whether early-stage venture, or mid-stage growth, investors are adopting a different approach to what they are looking for, how much they are putting to work, and what they expect to see as an end result. This is proving true not just in the tech sector, but cleantech, medical device, and biotech.

If CEOs are looking for more investment, whether growth equity, seed capital, or something in between, what are the "new normals" to think about going into 2011. And if CEOs aren't looking for money, but looking for exits, what are the expectations of investors in 2011 and beyond?

We assembled a panel of venture capital investors who all had raised new funds in the last year or so. These investors also represented a different flavor than traditional venture capital.

On the panel?

- Michael Balmuth, General Partner, Edison Venture Fund

- Alexis Borisy, Partner, Third Rock Ventures

- Rob Day, Partner, Black Coral Capital

What were the "new normals" CEOs and VCs talked about?

Here are a few that got some air time:

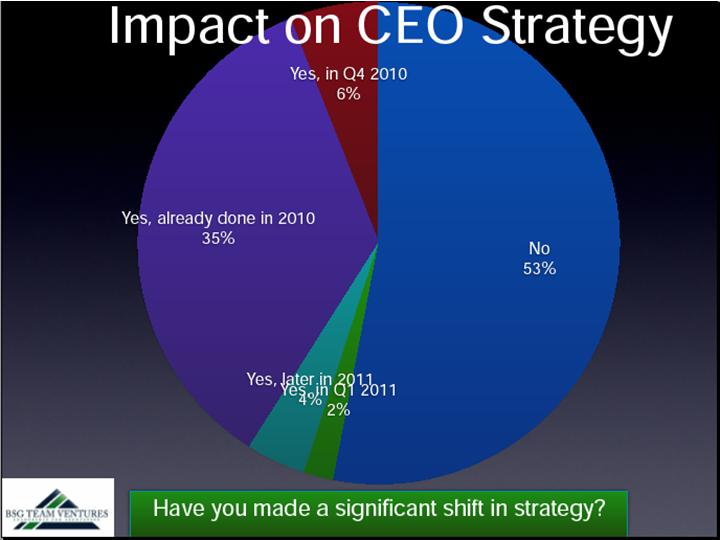

2011 is likely to be an economic "ground hog year." The current economic cycle of "flat is the new up" is here to stay for the medium term; In taking a flash vote of the room, the overwhelming majority felt that the economic conditions in which companies are being created are not going to change for the better any time soon. Simply turning the calendar over from 2010 to 2011 is not likely to yield a more fertile or forgiving economic climate in which to grow innovation-stage companies. In our recent survey of growth-stage CEOsfor Q4 2010, we noted in a prior blog post that the vast majority of CEOs had already shifted their strategies or were planning to in the near future as a direct result of an expectation that 2011 might look a lot more like the end of 2009 or 2010 than '07 [see CEO survey pie chart below]

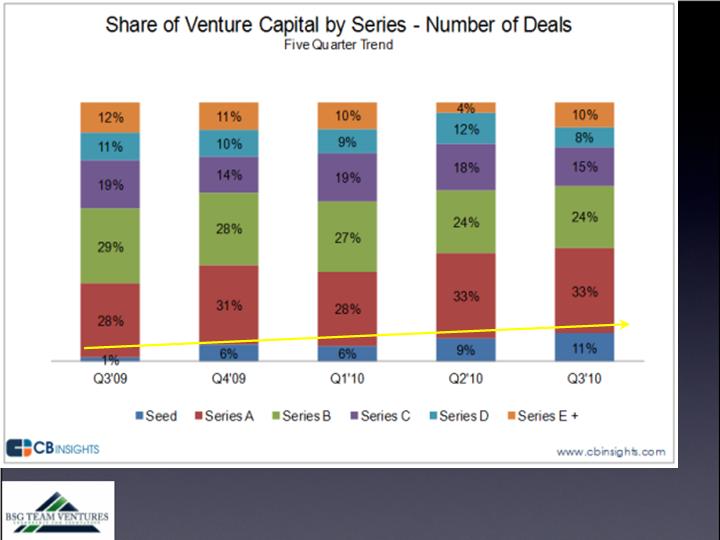

Seed rounds are becoming pervasive compared to prior quarters. And these aren't for Web 2.0 companies only. CB Insights in their Q3 2010 summary demonstrated that this is a trend that is occurring in cleantech / greentech as well as healthcare IT. All 3 investors on the panel agreed that seed funding makes sense. Alexis Borisy, Partner at Third Rock Ventures, talked about their approach to seeding, saying that they tend to help start the companies, not just fund them, often taking an interim role on the executive team to incubate to a point of value inflection. Michael Balmuth mentioned that although Edison Ventures doesn't do "seed stage investing" per se, he loves to see companies that get seed rounds, as it often is an effort to drive toward profitability faster. At that point, Edison may be more interested in a seed-funded company that achieves an early positive cash flow position than a typical heavily syndicated, multi-series venture-backed portfolio company. Black Coral's Rob Day added that he felt that investing in capital-efficient companies, even in the cleantech sector, was something he has advocated for a long time. [see CB Insights graph of growth in seed round funding over last 5 trailing quarters, 2009-2010]

- As an asset class, venture funds have lost money for a while now. Limited partner investors in venture capital and even private equity believe that they still have to invest in this asset class because it does make money during economic or industry sector bubble periods, and to invest once a bubble has been established would mean missing the upside. During other times, LPs try their best to pick the funds that outperform their peers.

- Using investment banks to raise equity capital should be done selectively. If the industry is a small one, and the network is well established (like biotech investing Alexis pointed out), using an i-bank at an early stage is not the best idea. However, in the cleantech sector where there are more total number of investors, they are internationally distributed, the industry is younger and less well-networked, and there is an imbalance in demand-supply (more money chasing fewer good deals), the investment banking solution may be just the right one. One CEO, Larry Letteney of Second Wind in the cleantech sector, shared just such a recent positive experience in going out for their next round.

- Seek out funds that have real capital to invest, preferably "fresh." Each of the three funds represented on the panel had all raised funds in the last twelve months or so. But there are a lot of funds that are at the end of their last fund. Many are unlikely to raise another fund. Many investors are taking meetings, but setting the bar exceedingly high because they have only an investment or two left, and they don't want to get caught making a bad one given the challenge in delivering returns to LPs in the most recent investing vintages. There was also a "beware" comment about funds who are making seed round investments at the end of their funds. They are more likely to do so, as it is an easier story to message an investment mulligan to LPs if you can just say, "It was just a small seed investment, so no biggie." Caution was also expressed that an investor at the end of a fund making a seed investment will be less likely to have additional capital to invest even if the company is doing well.

We hope to post a video snippet of the the VC-CEO dialogue for a flavor of the evening's conversation in the near future.