For executives looking for the next career step, use this decoder ring—

What to share through to search firms, your business network, and friends & family to thoroughly and efficiently communicate what your career “painted picture” looks like

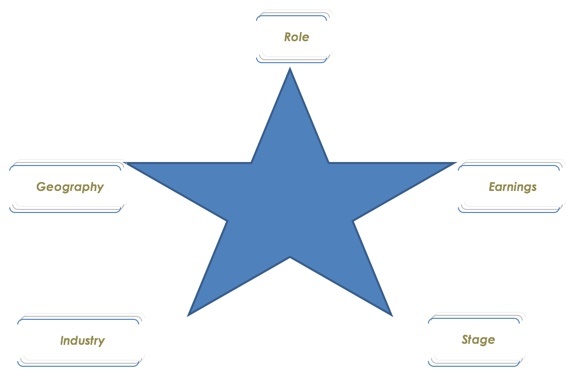

We often get asked to consider an unsolicited executive profile as we work on those retained searches on which we’re engaged. We’re always happy to learn about new executive talent, or get updates from those already in our constellation of relationships. As a quick primer on most valuable information to share through along with your resume, here are the key ingredients, wrapped around a graphic we call the career 5-pointed star “RESIG” model (think “resignation” from your current position to move to the next):

Starting at the 12-o’clock point of the star and moving clockwise:

- ROLE: Role is comprised of 2 sub-headers-- the functional area and level within the organization. Note that an executive needs to consider both what they’re most interested in as a role, and for what they are also best qualified. To say “surgeon” but to not have gone to medical school may be aspirational, but not realistic. To say “CEO” but never to have held P&L responsibility is similar.

- EARNINGS: The easiest way to think about this is to frame minimum earnings as “what’s my family ‘burn-rate’?” How much do I need to earn at minimum to neither SAVE, nor BURN (spend/withdraw from savings). Or, think about it in the opposite fashion—no matter how compelling the opportunity, I simply can’t make ends meet unless the likely annual compensation is equal to or greater than $X. Note that the “x” includes base salary and “targeted” or “expected” bonus. If a position were 250K base and 20% bonus opportunity, the “expected” bonus payout is typically less than the maximum bonus. If someone does extraordinarily well in a role, they might get 100% of the bonus, and only if the company also performs well in that same given year.

- STAGE: In simple terms, this refers to 3 variables defining stage:

- Public or privately held?

- Size of revenues/employee base

- Emerging, growing, mature, or declining, where—

- emerging often is venture-backed or bootstrapped

- growing, if privately owned, is often private equity/growth capital backed or family-owned and if public, it’s a “high growth stock”

- mature, if a company is fairly stable. If private is not expanding geographically, by acquisition strategy, or employee headcount. If public, then a “dividend stock.”

- declining, if a company is either entering or likely to enter a “turn-around” stage. If privately held, there is often private equity entering the equation to buy it and fix or sell off its parts, if publicly held more often than not it’s a “value stock” or valuation that is more tied to cash on hand vs. P/E multiples.

- INDUSTRY: The industry sector in which you are both most interested and most qualified. Broadly, you could categorize it into—

- Services, manufacturing, technology, sciences, healthcare, natural resources, retail, etc.

- More narrowly, there are many different subsectors. Using healthcare as an example, it could be on the provider side of healthcare (hospitals, medical care, etc.), payers (health insurance related companies), and “creators” like those who develop medical devices or new drug therapies.

- See “ground rules” below for additional context on impact on earnings & estimated length of job search if shifting industry

- GEOGRAPHY: The first question to ask is, “am I looking for the best role that is commutable from my current home,” or, “the best role I can find in pre-selected locations”?

- If the latter, it’s best to stack rank those geographies in which you’re most to least interested.

- Alternatively, you can also add, “urban, suburban, or exurban/country”

- Finally, do include international locations if viable and of interest, “London, Paris, Rome” or “metropolitan Asia (Hong Kong, Seoul, Shanghai) for example.

Ground rules:

- Remember to run your thinking through the “what am I both qualified AND interested in” rule

- Remember that for each step you take away from the role & industry & level you are currently serving—in other words, the position for which you are “most qualified)—you will likely go down in compensation as you are not as proven in this new role as you would be stepping into the exact same role in the same industry in the same stage of company, etc. In addition, the length of estimated job search should either be multiplied by 1.5 or 2x.

- Remember that for some executives, relocation is sometimes going to be essential to retain your current earnings, role and/or industry.

- The more you earn, the longer it is likely to take to find your next role. There are some exceptions (high paying individual contributor revenue generating roles like bond trader, i-banker, or sales executive). However, for those roles that are classified as “manager of others” or “leader” roles the below parameters often apply—

- For those who earn between 100-200K, rule of thumb is add one month on top of a base rate of 3 months for every 15K of earnings above 100K (so if $150K, the math is 3+ (50/15), or 6.33 months.

- For those earning between 200-500K, For every $50,000 in annual earnings, it is likely going to take one month (200K = 4 months, 500K = 10 months)

- Note that for every 1% change of US unemployment rate up or down from an unemployment base rate of 5%, you can add/subtract a month to your estimate.

Interested in exploring the next step? View a partial list of our current opportunities: